The Chair of the All-Party Parliamentary Group on Limits to Growth recently tabled an Early Day Motion (EDM), asking: That this House welcomes the call made by President Michael D Higgins of Ireland, on 28th April 2023, to look beyond the current obsession with economic growth and rebalance economy, ecology and ethics.

Publications

The APPG on Limits to Growth regularly commissions briefings and reports. On this page you’ll find a list of publications so far. For more information about the underlying research, see the research page.

Targeting Sustainability—A review of the UK Government’s outcome delivery plans | Briefing Paper

In July 2021 the UK Government introduced a new system of outcome delivery plans (ODPs), designed to improve its focus on the delivery of key national priorities. This briefing examines this initial collection of ODPs, and holds it up to the findings of previous research on good practice—especially relating to the environment and wellbeing (sustainable prosperity) agenda.

Tackling predatory financial practices in the adult social care sector | Briefing note for Health and Care Bill Committee stage amendments 237, 238 and 239

This briefing note covers Health and Care Bill Committee stage amendments 237, 238 and 239. They seek to address the use of predatory financial practices by private sector firms operating in the adult social care sector. They have been tabled by Baroness Bennett of Manor Castle and were discussed on 4 February 2022.

Predatory financial practices and the adult social care sector | Early Day Motion #767

APPG vice chair Clive Lewis MP tabled an Early Day Motion (EDM) to call on the Government to address the predatory financial practices as exposed in the recent BBC Panorama reportage ‘Crisis in Care: Follow the Money’ by amending the Health and Care Bill to prevent financial assistance being mis-used. Co-sponsors of the motion are Caroline Lucas, Dan Carden, Kate Hollern, Kim Johnson and Jim Shannon.

Tackling predatory financial practices in the adult social care sector | Briefing note for second reading of the Health and Care Bill

The Health and Care Bill has its second reading in the House of Lords on Tuesday 7 December. Coinciding with a new Panorama investigation, Crisis in Care: Follow the Money, this briefing proposes three ways in which the Health and Care Bill should be amended to tackle the harmful impacts of financialisation in the care home sector.

Beyond the Debt Controversy—Fiscal and monetary policy for the post-pandemic era | Briefing Paper

In the years since the financial crisis, a heated debate has broken out amongst macroeconomists about the appropriate roles of fiscal and monetary policy in managing public sector debt. This briefing introduces the main lines of argument on both sides of the controversy. It finds i.a. that a return to fiscal austeritywould be both dangerous and unjustified and that moving beyond ideology is key to the levelling-up agenda.

Placing sustainable prosperity at the heart of the economic recovery – a new Beveridge report | Letter to Cabinet Office minister Michael Gove

The APPG has written to the Chancellor of the Duchy of Lancaster and Minister for the Cabinet Office the Rt Hon Michael Gove MP, to set out recommendations to the Cabinet Office for commissioning a new Beveridge report, to research and consult the public on the innovations required to ensure public policy is fit to address the UK’s most important needs for the twenty-first century.

Tackling growth dependency—the case of adult social care | Briefing Paper

On 13 July 2021, the APPG on Limits to Growth launched the fourth briefing in our policy paper series, which provides a framework for identifying, analysing and transforming growth dependencies in the welfare state. Using adult social care as our case study, we explore how growing demand, rising costs and rent seeking can create growth dependencies, and how to tackle them.

Budget 2021: Five priorities for a green and fair economic recovery | APPG letter to the Chancellor, 1 Mar 2021

MPs and peers from two all-party parliamentary groups have written to the Chancellor urging him to use the 2021 Spring Budget to build a green and fair economic recovery post Covid. As the last Budget before the UN climate summit (COP26), the Budget will be a litmus test of the UK’s climate leadership, says the letter, and must deliver action on climate and nature.

Gross Domestic Wellbeing | Early Day Motion #1235

APPG chair Caroline Lucas MP tabling EDM—calling on the House of Commons to welcome the recent work on Gross Domestic Wellbeing by the Carnegie Trust, the aim of developing holistic approaches to understanding and measuring progress that focus on people’s wellbeing, rather than GDP growth; and to put this agenda at the heart of all policy making, including budgets, as part of ‘Building Back Better’.

A post-growth recovery? | APPG letter to the Chancellor, 7 July 2020

The APPG on Limits to Growth has written to the Chancellor Rishi Sunak urging him to prioritise wellbeing if his plans to rebuild the economy after Covid are to lead to a green recovery. Green jobs and funding for traineeships expected to be announced by the Chancellor are welcome, but a truly green recovery means pivoting to an economy where the measures of success are public health, personal and social wellbeing and the health of the natural environment rather than GDP growth statistics.

Wellbeing Matters—Tackling growth dependency | Briefing Paper

This policy briefing highlights some alternatives to the conventional approach to measuring social progress. It presents a three-fold strategy for moving beyond GDP by: changing the way we measure success; building a consistent policy framework for a ‘wellbeing economy’; and addressing the ‘growth dependency’ of the economy.

Proposals for a sustainable and inclusive wellbeing economy | Early Day Motion #196

APPG chair Caroline Lucas MP tabling EDM—calling on the House of Commons to welcome the formal opinion on a sustainable and inclusive wellbeing economy, adopted by the European Economic and Social Committee on 24 January 2020; and on HM Treasury in particular to at least match the ambition and leadership shown by the EESC.

Climate, Nature and Growth | Early Day Motion #2382

APPG chair Caroline Lucas tabling EDM, calling on Govt to show leadership in acknowledging and developing alternatives to consumption-based economics.

Beyond Redistribution—Confronting inequality in an era of low growth | Briefing Paper

The second in our series of briefing papers on building An Economy That Works explores inequality in the UK. It examines the evidence for rising inequality over the last fifty years, estimates the economic welfare lost to society from an unequal distribution of incomes and addresses the critical question of managing inequality in the context of declining growth rates.

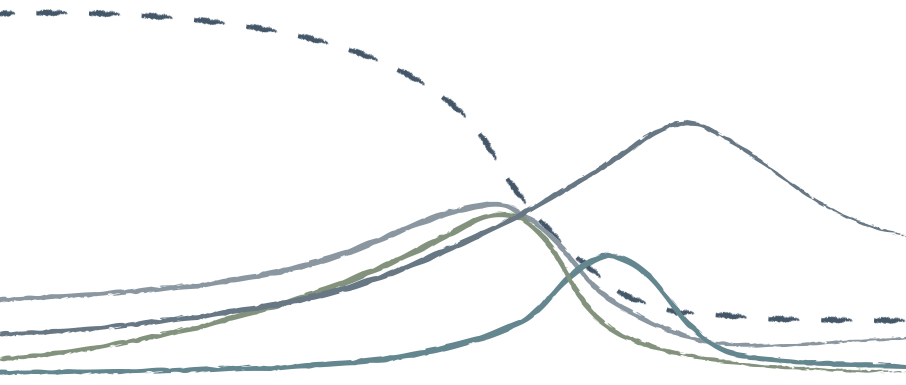

Understanding the ‘New Normal’—The Challenge of Secular Stagnation | Briefing Paper

This first in our series of briefing papers on building An Economy That Works explores the underlying phenomenon of ‘secular stagnation’—a long-term decline in the rate of growth of the Gross Domestic Product (GDP). The paper examines the evidence, explores the causes and discusses the implications of what some now call the ‘new normal’.

Understanding, Safeguarding and Strengthening the Precautionary Principle | Briefing Paper

Uncertainties over which EU environmentally-related policies are likely to be culled in the process and aftermath of the ‘Great Repeal Bill’ should be cause for concern regarding the long term health of both humans and the ecosystems on which we all depend. The Precautionary Principle offers a comprehensive defence against policies which favour ‘growth’ at the cost of potentially irreversible or catastrophic risk.

Spring Budget 2017 | Response by the APPG on Limits to Growth

Budgets are routinely analysed by people who believe there is nothing problematic about economic growth. Forecast rates of GDP growth play a key role in the Budget calculations, and Budgets are praised or criticised based on the e ect they are deemed to have on future growth. In our view, such analysis misses a critical aspect of the contemporary debate: namely the prospect that there may be environmental, social and secular limits to economic growth.

Limits Revisited: A Review of the Limits to Growth Debate | Report

Four and a half decades after the Club of Rome published its landmark report on Limits to Growth, the study remains critical to our understanding of economic prosperity. This new review of the Limits debate outlines the contents of the Club of Rome’s report, traces the history of responses to it and dispels some of the myths surrounding it. One of the most important lessons from the study is that early responses are absolutely vital as limits are approached.